Support & Resistance Levels – Price Action Trading

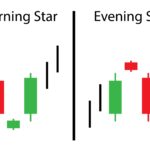

While understanding the candlestick pattern, we had known about the entry and stoploss points, but we did not talk about the target price at that time. We will focus on that in this chapter.

The best way to determine the target price is to find the support and resistance points. Support and resistance are called S&R in short. Support and resistance indicate that specific price point in a chart at which the most buying or selling takes place. The support price is the price at which the number of buyers can be expected to exceed sellers. Similarly, there is a possibility of more sellers than buyers at the resistance price.

With the help of S&R, the trader can know the right time to enter into any trade i.e. the entry point.

The Resistance

The meaning of the word resistance in Hindi is – hindrance, restraint or hindrance. So on the basis of this meaning, we can say that resistance prevents the price from moving up or down. The term resistance is used in the stock market to describe the price point on the chart of a stock from which the price of the stock stops moving. At this price point, traders expect a maximum supply of the stock. The resistance level is always above the current market price (CMP) of the stock.

Below is the chart of Ambuja Cement Ltd. The horizontal axis/line i.e. the horizontal line is found on the chart at Rs 215, this will be the resistance level of Abuja Cement.

I have deliberately put more data points on the chart, the reason for which will be explained in a while. But before that, while looking at this chart, you have to pay attention to 2 things.

The resistance level, indicated by a line, is at or above the current market price.

The resistance level is at 215 and the current candle is at 206.75. The current candle and its price level are shown by the black circle.

Let’s assume for a moment that Ambuja Cemets makes a Bullish Marubozu at Rs 206 with a 202 low. We know this is a signal to start a long trade, and we also know that the stop loss for this trade will be at 202. With this new information on resistance, we now know that we can set a target price of 215 for this deal.

You might be thinking, “Why only 215?” The reasons are very clear:

Resistance at 215 means that the supply is likely to remain high at this level.

More supply means selling pressure means pressure to sell

When selling pressure builds up, prices are likely to go down.

So for these reasons, traders with long positions can decide the target and exit points for the trade by looking at the resistance points.

Also, with resistance identified, a long trade can be like this:

Entry – 206, Stoploss – 202, Target – 215

The next question would be how do we find out the resistance level? It is very easy to find out whether the price point is support or resistance. If the price point is above the current market price, it is a resistance point and if it is below it is a support point.

Now let us further understand ‘Support’ and learn how to locate the support point.

The Support

Once you know about resistance, it should be fairly easy to understand support. As the name suggests, support is something that supports the price and prevents it from falling. The support level is the price on a chart where the trader expects maximum demand (in the case of buying) in a stock (or index). Whenever the price falls to the support level, there is a possibility of a bounce back as buying is expected at that price. Support is always below the current market price (CMP).

There is a high probability that the price will fall to the support, rest until the demand at that price is satisfied, ie, consolidate and then start moving upwards. Support is an important technical level in a falling market that is watched with great care. Support is often considered a buying trigger.

Here is the chart of Cipla Ltd. The line drawn at 435 on the chart shows the support price for Cipla.

Some things that you need to pay attention to in the above chart:

The support level shown by a straight line is below the current market price.

The support price is at 435 while the candle is currently at 442.5. The current candle and its corresponding price level are circled for your reference.

Similar to what we did with the resistance, let us imagine a bearish pattern forming – a shooting star is formed at 442 with a high of 446. We know that to short with a shooting star, then to short Cipla at 446, with a stoploss of 446. Since we know that 435 is the current support, we consider this as our target.

So what are the reasons why we might consider the target of 435 to be correct? Our decision is correct for the following reasons:

Support at 435 means that there is a high probability of additional demand coming in at this price.

Excess demand creates buying pressure.

Buying pressure builds up causing the price to rise.

Because of the above reasons, when a trader places a trade, he can look at the support level to set the target and exit the trade.

Also, with support identified, the short trade is now fully designed.

Entry – 442, Stoploss – 446, and Target – 435

Understanding Support and Resistance Levels and Drawing Lines

Now we are telling you 4 such steps, with the help of which you can find the right level of resistance and support and also draw support and resistance lines.

STEP 1) Load the data points – If short term S&R is to be done then at least 3 to 6 months data points have to be loaded. If you want to identify longer term S&R, load data points of at least 12 – 18 months. When you load multiple data points, the chart looks compressed. This also explains why the top two charts looked shrinking due to this reason.

Long term S&R – Useful for swing trading

Short term S&R – Useful for intraday and BTST – BTST trades.

Here is a chart where I have loaded 12-month data points

Step 2) Identify at least 3 price action zones – A price action zone can be called a sticky point on a chart where prices must exhibit at least one of the following behaviors:

Stuck in going up and down after some acceleration

after a few falls and getting stuck in a fall

change direction rapidly at a single price

Here is a series of charts showing the 3 points above in the same order:

In the chart below, dotted circles indicate a hesitation to proceed after a brief move:

In the chart below, the circled points hesitate to push the price further down after a brief down move:

In the chart below, the circled dots represent a sharp change in direction on price:

Step 3) Matching price action zones with a straight line – When you look at a 12 month chart, you usually see several action zones. Here you have to find at least 3 price action zones that are on the same level in terms of price.

For example here is a chart showing 2 price action zones but at different price levels.

Now look at this chart where I have shown 3 price action zones surrounded.

An important point to note when identifying these price action zones is that these price zones are well spaced in time. Meaning, if the first price action zone is in the 2nd week of May, the second price action zone should occur any time after the 4th week of May. (well away in time). The greater the distance between two price action zones, the better the identification of the S&R.

Step 4) Fit a Horizontal Line – Connect the three price action zones with a horizontal line. Depending on where this line is in relation to the current market price (CMP), it becomes either a support or a resistance.

take a look at this chart

Starting from the left then:

The first circle shows a price action zone where the price reverses sharply.

The second circle highlights the price action zone where the price is sticky.

The third circle indicates a price action zone where the price reverses direction sharply.

The fourth circle highlights the price action zones where the price is sticky.

The fifth circle shows the current market price of Cipla – 442.5.

In the above chart, all the 4 price action zones are at the same price points i.e. around 429. Obviously, the horizontal line is below the current market price of 442.5, thus 429 becomes an immediate support price for Cipla.

Please note, whenever you look at charts in technical analysis, such as identifying the S&R by just looking at it, you can make a mistake. The price level is usually represented in a range and not a single price point. Support or resistance is an area or zone, not a fixed price.

So based on the above logic, I see a price range between 426 to 432 as a support for Cipla. There is no specific rule for this range, I just added and subtracted 3 points from 429 to get the price range of support.

Here is another chart where both the S&R for Ambuja Cements Ltd. has been identified.

Ambuja is currently trading at 204.1, showing support at 201 (below current market price), and resistance at 214 (above current market price). So if one was short in Ambuja at 204, the target could be at 201 depending on the support. Probably it will be a good intraday trade. For the long trader at 204, 214 could be an appropriate target depending on the resistance.

Note that, at both the support and resistance levels, at least 3 price action zones have been identified on the price level, which are well spaced from each other in time.

Support &Resistance’s Reliability

Support and resistance lines are only an indication of the possibility of a price reversal. In no way should they be considered fixed. Like everything else in technical analysis, one must weigh the probability (based on the pattern) as the probability.

For example, based on the chart of Ambuja Cements – Current Market Price = 204

Resistance = 214

Here the expectation is that if Ambuja Cement starts going up then it is likely to face a resistance at 214. Meaning, there could be a selloff at 214 which could potentially pull the prices down. Is there a guarantee that sellers will come to 214? In other words, what is the dependence of the resistance line? Honestly, your guess is as good as mine.

However, historically it can be seen that whenever Ambuja reached 214, it reacted in a certain way, making it a price action zone. The consoling thing here is that the price action zone is well timed. This means that 214 is in a price action zone that has been tested time and again. So keeping in mind the first rule of technical analysis i.e. “History repeats itself” we can be confident that support and resistance levels will not be easily broken.

Based purely on my personal trading experience I can say that well made S&Rs usually turn out to be correct.

Optimization and Checklist

Perhaps, we are now at the most critical juncture in this module. We will start by exploring some modifications or optimization techniques that will help us identify the best trades. Remember, when you want to spot good trends, you have to give up the temptation to spot too many trends. It’s always better to identify a few but firm trends than to identify lots of but untested trades.

Optimization in general is a technique in which you design a process for the best results. The process is all about identifying the best trends.

Let us go back to the candlesticks pattern, probably the first one we learned – the Bullish Marubozu. The Bullish Marubozu suggests a long trade, the low of the Marubozu acting as the stoploss in this trade being close to the Marubozu.

Assume the following for a Bullish Marubozu:

Open = 432, High = 449, Low = 430, Close = 448

In this situation the entry for the long trade is around 448, and the stoploss is 430.

Now what if Marubozu’s take matches up with the proven support from time immemorial? Do you see a good confluence of the two technical principles here?

We have double confirmation to go Long. Think about the following terms:

A recognized candlestick pattern (Bullish Marubozu) suggests the trader to initiate a long trade.

Support near the stoploss price tells the trader that a significant buy may occur near the low.

What a trader really needs is a well-crafted trade setup in an uncertain place like the markets. Both the conditions mentioned above (Bullish Marubozu + Support near Low) suggest the same action – to initiate a long trade.

This leads us to an important idea. What if we had a checklist for each business (you can call it a framework if you like). This checklist will act as a guiding principle before starting each trade. Every trade must comply with the conditions given in the checklist. If the conditions are met, we will place the trade, otherwise we will discard it and look for a new opportunity that complies with the checklist conditions.

It is said that 80% of a trader’s success is based on discipline. In my opinion the checklist forces you to be disciplined, it helps you to avoid making hasty and careless decisions.

To really start we have the first two very important factors of the checklist:

A recognizable candlestick pattern should form in the chart of the stock.

Note: We have learned some popular patterns in this module. You can use these same patterns in the beginning to follow the checklist.

S&R should confirm the trade. Stoploss should be around S&R.

For a long trade, the support should be around the low of the pattern.

For a short trade, the high of the pattern should be around the resistance of the stock.

Later in this module, we will build this checklist as we learn new TA- Technical Analysis concepts. But to calm your curiosity, let us tell you that there will be 6 checklist points in the final checklist. In fact when we have all 6 checklists

Gaurav Heera is a leading stock market educator, offering the best stock market courses in Delhi. With expertise in trading, options, and technical analysis, he provides practical, hands-on training to help students master the markets. His real-world strategies and sessions make him the top choice for aspiring traders and investors.