There are about 6000 stocks listed in Bombay Stock Exchange (BSE – BSE) and about 2000 stocks listed in National Stock Exchange (NSE – NSE). Can you find the right opportunity for you among these thousands of stocks every day? No no! For this, you have to choose such stocks in which you can trade easily. This set of stocks will be the world or universe for you from which you will be able to find opportunities for yourself every day.

But how would you choose these stocks? Let me tell you some principles for this:

First of all see that there is sufficient liquidity in the stock. To see this, once you see the count of bid and ask. If the difference between the bid and the ask is less then it means that the stock is liquid.

If you want, you can also measure the volume instead, just decide that there will be at least that much volume only then I will trade. For example, you may decide to trade only those stocks that have a minimum volume of 500000 shares.

Also ensure that the stock is in the EQ segment, this is necessary as day trading is allowed only in the EQ segment stocks. That is, day trading can be done in these. Although I have advised newcomers not to do day trading, but if you have taken a position and your target comes on the same day, then there is no harm in closing your position and exiting that stock.

You should also try to make sure that this stock is not the same that the operator runs. However, it is a bit difficult to find out which is the operator’s stock? There is no direct way to know it, it can just come from experience.

If there is a problem in choosing such stocks which fulfill the above conditions, then I would advise you to stick with Nifty 50 or Sensex 30 stocks. These stocks, known as index stocks, are selected by the stock exchange itself and the process of their selection is very good. In addition, the above conditions are also complied with.

Trading in Nifty 50 stocks is a good idea for swing traders and scalpers as well.

Finding Opportunities (The Scout)

Let us now see how to choose the stocks in which we can trade. For this we try to create a process by which you can choose the right trading opportunity for you. This would be a great approach especially for the swing trader.

So far we have understood four very important things:

- Charting Software – In which we recommend that you use trading view.

- Timeframe – Use end-of-day data.

- Opportunity Universe – Nifty 50 Shares

- Mode of trade – trade position but in which the path is open to close the position when the target is met within the day itself.

- Look Back Period – At least 6 months to 1 year of data and if working on S&R then extend the data up to 2 years.

It is very important to complete these important things. Next, let me explain how I find trading opportunities for myself. I have divided it into two parts.

The shortlisting process

I look at the chart of Opportunity Universe stocks.

In the charts of these stocks, I only look at the most recent 3 or 4 candles.

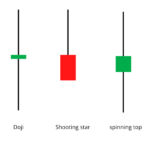

When I watch these 3 or 4 candles I look for any identified candlestick patterns.

If I see a recognized candlestick pattern, I take a deeper look at that stock.

The Evaluation Process

- After doing all this, I usually get 4 to 5 shares which are part of the opportunity universe of my 50 shares. Now I check these 4-5 stocks in depth. I usually spend 15 to 20 minutes on each stock’s chart and see that:

- How strong is the pattern shown? Especially I also try to see if I need to be a little flexible in terms of patterns?

- For example, if a Bullish Marubozu has a shadow, I try to find out how the length of this shadow is relative to that range.

- Then I look at past trends. The trend before the Bullish trend will be downtrend. Similarly, in the Bearish trend the previous trend should be upwards i.e. uptrend.

- After I have found a recognized pattern and have tracked the previous trend in the right direction, I begin to investigate the stock further.

- Then I look at the volume. Volume must be equal to or higher than the average of at least the last 10 days.

Once the candlestick pattern and volume are confirmed, I try to identify support (in long trades) and resistance (in short trades). - As far as possible the S&R level should coincide with the stoploss (candlestick based) of the trade.

- If the S&R level is more than 4% away from the stoploss, I stop evaluating the chart further and move on to the next chart.

- Now I look for Dow patterns – specifically double and triple top and bottom formations, flag formations and the possibility of range breakouts.

- Also, I see the primary and secondary trends.

- If all goes well so far i.e. everything 1 to 5 above is satisfactory, then I start seeing RRR.

- To find out RRR, I fix my target based on resistance or support.

- RRR must be at least 1.5.

- Lastly I look at the MACD and RSI indicators, if they confirm and if I have money then I increase my trade size.

Usually 1 or 2 out of 4-5 shortlisted stocks are worth trades. Sometimes there is not even a single trade opportunity. This decision not to trade is also a big decision in itself. Remember that this is a very strict checklist, if a stock confirms the checklist, my confidence for that trade goes up a lot.

Let me reiterate here one thing I have said several times in this module – once you place a trade, do nothing until your target is reached or the stoploss is triggered. Yes, you can definitely trail your stoploss. If your trade follows the checklist then it is more likely to be successful.

The Scalper

Another option for an experienced swing trader is scalping. The scalping trader makes large trades but only for a few minutes. After a few minutes, he exits this trade.

| First Phase of Trading | ट्रेड का दूसरा हिस्सा |

|---|---|

| 10:15 AM | 10:25 AM |

| Share-Infosys | Share-Infosys |

| Price-3980 | Price-3976 |

| Sell | Buy |

| 1000 Shares | 1000 Shares |

Total profit after charges = Rs 2644

Note, this calculation of total profit is done assuming that you are trading on Zerodha or angel one, if you are scalping at an expensive brokerage rate then profits may be lower. In order to be profitable in scalping, it is very important to have low transaction charges.

A scalper is a trader whose entire focus is on the price. He decides his trades on the basis of charts with time frames of 1 minute and 5 minutes. The scalper makes several trades a day. His goal is clear – make several small trades a day and keep them for a few minutes only. He can also benefit from a small move in the stock and he tries to do the same.

If you want to become a scalper then I am giving some guidelines for you-

Remember the checklist we mentioned above, but don’t expect to follow all the points on the checklist as the trade period is very short.

- If I had to specify only 1 or 2 important points in my scalping checklist, I would choose candlestick patterns and volume.

- An RRR of 0.5 to 0.75 is considered good even when scalping.

- Scalping should be done only in liquid stocks.

- Have good risk management – Be ready to book losses immediately when needed.

- Keep an eye on the Bid and Ask ratio to see how the volumes are doing.

- Keep an eye on other markets in the world as well – for example, if the Hang Seng (Hong Kong Stock Exchange) drops suddenly, there may be a sudden fall in the domestic markets as well.

- Choose a low cost broker to reduce your costs.

- Use margin effectively, don’t over leverage.

- Use a reliable intraday charting software.

- If you feel that the day is not going well, stop trading and move away from your terminal.

To use scalping as a day trading technique, one needs to have quick judgment and a machine-like habit. A successful scalper is not afraid of market volatility but likes it.

Highlights of this chapter

- If you want to become a good technical trader then you will need a good charting software, my choice would be tradingview.

- For day trading and swing trading, use the end-of-day chart i.e. EOD chart.

- If you are scalping then use intraday charts.

- Use a look back period of at least 6 months to 1 year for swing trading.

- To start with, use Nifty 50 as the Opportunity Universe.

- Find the opportunity in 2 parts.

- In the first section, look at all the charts in your Opportunity Universe and shortlist a few stocks.

- For the second part, go through the chart of the shortlisted stocks more deeply and choose the right opportunity.

- Scalping is for those who are good or old swing traders.

Pioneering Excellence as the Best Stock Market Institute in Delhi.

Gaurav Heera is a leading stock market educator, offering the best stock market courses in India. With expertise in trading, options, and technical analysis, he provides practical, hands-on training to help students master the markets. His real-world strategies and sessions make him the top choice for aspiring traders and investors.