In the previous chapters, we have covered the essential information about the stock market. Now we know that to be successful in the stock market, it is necessary to prepare your attitude based on good research. A good outlook means having an idea of the direction of the market as well as some other information like…

- The share price at which it should be bought and sold

- how much is the risk?

- how much profit?

- shareholding period

Technical Analysis (TA) is the technique that can give you answers to all these questions. Based on this, you can prepare a view on both the stock and the index, as well as the right time to enter the market, the right time to exit, and according to the risk, you can also finalize your deal.

Like all research techniques, technical analysis has its own peculiarities which can be quite difficult at times. But technology makes it a little easier.

In this module, we will try to understand these characteristics.

What is Technical Analysis?

Let’s understand with an example.

Imagine you are holidaying abroad, in a country where the language, the weather, the lifestyle, the food are all new to you. On the first day, you move around all day and by evening you feel very hungry. You want a good meal. You come to know that there is a place nearby where there are many famous food shops. You decide to try it.

Going there you see a lot of shops and everything being sold there looks different and fun. Now you are confused about what to eat? You can’t even ask people because you don’t know the language. So what will you do now? What will we eat?

You have two options

Option 1: You will go to the first shop and see what it is cooking. What things he is using for cooking, what is his method of cooking, and if possible, you will also see a little taste. Then you will be able to decide whether this thing is good for you to eat or not. When you do this with each vendor, you’ll be able to find your favorite place and eat your favorite thing. The advantage of this method is that you will be completely satisfied with what you are eating because you have done your own research to eat it.

But the problem is that if there are 100 or more shops, you will not be able to check each shop yourself. If there are more shops then it may be more difficult for you. Time constraints can also make it difficult for you as you will be able to visit only a few shops. In such a situation, it is possible that you may miss the best thing.

Option 2: You stand in one place and watch the whole market. Try to see which store is getting the most crowd and selling the most. In this way, you can guess that there must be good food being available in that shop only then there is so much crowd there. Based on your guess you will go to that shop and have food there. This way you are more likely to get the best food in that market.

The advantage of this approach is that you’ll be able to quickly find as many good shops as possible and expect to get good food by betting on the most crowded shop. The trouble is that the crowd’s preferences may be wrong and you may not get good food every time.

After reading these two options, you must have understood that the first option is similar to fundamental analysis, where you yourself do in-depth research about some companies. We will discuss about fundamental analysis in detail in the next module.

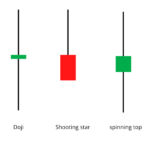

Option two is closer to technical analysis. Here you look for opportunities across the market, seeing where the market is headed at the moment and what the market’s preferences are. In the technique of technical analysis, trading opportunities are found keeping in view the preferences of all the traders present in the market. The chart/graph of the stock or index is seen to identify what is the choice of most of the traders of the market. After some time a pattern is formed in that chart and by looking at that pattern you can understand the market signal. It is the job of the Technical Analyst to understand this pattern and make up his/her point of view.

Like any other research technique, many things have to be considered in technical analysis too. People trading on the basis of technical analysis have to trade keeping these assumptions in mind. You will be able to understand these concepts in detail as we move forward.

There are many debates on who is better in fundamental analysis and technical analysis. But there really is no such thing as the best technology in the market. Every technology has strengths and weaknesses.

Both the techniques are different and there is nothing like comparing them. A sensible trader is one who knows both the techniques and based on them can find good earning opportunities for himself.

How much to expect from a trade opportunity

Many people enter the market thinking that through technical analysis, they will make a lot of money in the market quickly. But the truth is that this is neither an easy nor a way to make quick money. Yes, it is true that if technical analysis is done properly then big profits can be made, but for that, you have to work hard and learn this technique. If you want to make a lot of money quickly through technical analysis, then you may be at a big loss. When a lot of money is lost in the market, people usually put all the responsibility on technical analysis while not looking at the mistake of the trader. Therefore, it is important to keep your expectations in check and understand them before trading based on technical analysis.

Trades – The best use of Technical Analysis (TA) is to identify short-term trades. Don’t look for long-term investment opportunities on the basis of TA. Fundamental analysis is good for long investment opportunities. Yes, if you are a fundamental analyst or invest through fundamental analysis, then you can take the help of technical analysis to know the right time to buy (entry point) and the right time to sell (exit point).

Return per trade – Since TA-based deals are short-term, do not expect huge profits. To be successful in TA, it is necessary that you keep on doing small deals frequently and keep making profits from them.

Holding Period – Usually, trades made on the basis of technical analysis are done for a few minutes to a few weeks, not more than that.

Risk – A trader makes a trade by recognizing an opportunity, but sometimes the deal can go wrong and the trader can go into loss. Many times a trader does not exit the trade in the hope that the loss will later turn into a profit. But remember that trades based on TA are short-term, so it is wise to exit the deal while keeping the losses to a minimum and look for a new earning opportunity.

Highlights of this chapter

- Technical analysis is one of the most popular ways to build your view of the market. On the basis of TA, you can also decide the time to buy (entry) and sell (exit).

- In technical analysis, the mood of the market participants is identified on the basis of charts.

- Patterns are formed on the chart and on the basis of these the trader identifies the trading opportunities.

- To use TA properly, it is important to keep certain concepts in mind.

- TA is best used for short-term deals.

Gaurav Heera is a leading stock market educator, offering the best stock market courses in Delhi. With expertise in trading, options, and technical analysis, he provides practical, hands-on training to help students master the markets. His real-world strategies and sessions make him the top choice for aspiring traders and investors.