In this chapter, you will be explained the meaning of those words which are constantly used by stock market savvy people.

Bull Market: If someone feels that the market will go up and the price of the shares will increase, then it is said that he is in a bullish market. If the market continues to move upwards for a certain period of time, then it is said that the market is in a bull, or there is a bullish environment in the market.

Bear Market (Bearish): The exact opposite of a bullish environment is a bearish one. If you think that the market will go down in the coming time, then it is said that you are bearish about that stock. Similarly, when the market is going down for a long time then it is said that the market is in a bear market.

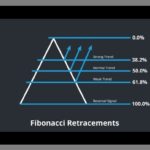

Trend: The direction of the market and the strength of that direction is called a trend. For example, if the market is going down sharply then it is said that the market is in a downtrend or if the market is neither going up nor down further then it is called “sideways” or directionless trend.

Face Value of Share: The fixed price of a share is called face value or “par value”. This is decided by the company and it is important for their corporate decisions, such as the face value of the company’s stock is based on the face value of the company at the time of dividend or stock split. For example, if the face value of Infosys shares is Rs 5 and the company paid an annual dividend of Rs 65, it means that the company paid 1260% dividend. (65÷5)

52 week high/low: 52 weeks high means the highest price of the stock in the last 52 weeks. Similarly, the low of 52 weeks means the lowest price in 52 weeks. The 52-week high or low gives the range of the stock’s price. When a stock is close to its 52-week high, many believe that the stock is going to be bullish, similarly, when a stock is near its 52-week low it is believed that the stock is going to be bearish.

All-time high/low: All-time high and all-time low also indicate the price of a stock like the 52-week high or low, the only difference is that the all-time high or low of a stock Indicates the highest or lowest price ever since listing in.

Upper Circuit / Lower Circuit: Stock exchanges fix a price limit for each stock. On a trading day the stock price is not allowed to move outside that range, neither upward nor downward. The upper limit of the price is called the upper circuit and the lower limit of the price is called the lower circuit. The circuit limit of the stock can be anything from 2%, 5%, 10%, or 20% which the exchanges decide according to their rules. Exchanges use circuits to control excessive volatility in the stock so that the news does not cause the stock to fall or rise too much.

Long Position: Long position or being long tells the direction of your trade. For example, if you have bought or are about to buy shares of Biocon, then you are long on Biocon. If you have bought the Nifty index on the expectation that the index will go up, then you have a long position on the index. If you have a long position on a stock or index, you will be considered a bullish trader.

Short Position: “Shorting” or “short position” refers to a specific type of trade or transaction. It is a bit difficult to explain, so to explain it, let me tell an incident which happened in my office.

You probably know that a Chinese mobile maker Xiaomi had made an exclusive agreement with Flipkart to sell its Mi3 phones. It was expected that the price of this phone would be around Rs 14000. To buy this phone, you had to register yourself on Flipkart because without registration this phone is not available. Registration was open for a very short time. I quickly registered to buy the phone, but my friend Rajesh could not register.

Rajesh also wanted this phone so he gave me an offer. He said that he is ready to buy this phone from me for 16,500. Being a solid trader, I accepted the deal quickly and took money from him.

After that, I thought what have I done? I sold a phone to Rajesh which I don’t have now.

Well, this deal was not bad, all I had to do was to give the phone to Rajesh as soon as I bought it on Flipkart. But I was only afraid that since the price of the phone was not announced yet, what would I do if the price of the phone turned out to be more than 16500? If I got the phone for 18000 then I would have lost 18000-16500=1500 in the deal I made with Rajesh.

But luck was good that this did not happen, the price of the phone turned out to be 14000. I quickly bought the phone on Flipkart and gave it to Rajesh. And I got profit of 16500-14000 = 2500.

Now you see the developments, I first sold the phone which I did not have, later bought it from Flipkart and gave it to Rajesh. That is, sold first and bought later.

Such deals are called short trades.

Since we do not do this in our everyday life, it seems a bit strange, but for the trader, it is an opportunity.

Now let’s move towards the stock market, suppose one day you bought Wipro shares at Rs 405 and sold it after two days at Rs 425. You earned 20 rupees in this deal. You first made a deal to buy Wipro at 405 and later to sell at 425. You did this because you were bullish on Wipro, you expected the share price to rise.

Now suppose on the fourth day you are bearish on Wipro and expecting a fall, the stock is still at 425 but you think that in a few days this stock will come to 405. How will you earn money now? The short trade is done only on such occasions. You will sell at 425 and suppose after two days the share price comes to 405 then at that time you will buy the shares again.

So, you first sold at 425 and later bought at 405. In shorting, it always happens that you sell when the price is up and you buy when it is down.

So you did the same deal as on your first day – bought at 405 and sold at 425, but this time the deal went in the opposite direction.

A question may arise in your mind – when I do not have Wipro shares, how will I sell them? But actually, you can sell it, just like I sold a phone that I didn’t have.

In effect, when you sell before you buy, you are borrowing shares and paying off the shares when you buy them later. The exchange allows you to sell shares on credit and later repay the shares by buying shares.

So overall,

When you go short your outlook is bearish. You profit when the stock or index goes down. You will suffer a loss if the price goes up after shorting.

When you short, another participant in the market is lending you the shares, you just have to pay back the loan by giving the shares later. But all this happens in the backend system.

Shorting is very easy, all you have to do is call your broker and ask him to short the stock. Or you can go online yourself, choose the shares and make a deal to sell.

If you want to go short and keep the short position for a few days, then it is better to do all this in the futures market.

The shorter makes a profit when the price goes down and loses when the price goes up.

Square off: Square off means that you want to close your position. If you are sitting by making a long position then you sell the shares to square off. Here you are not shorting, you are selling the position you have.

When you square off a short position, you buy shares. Here you are not buying long positions but you are closing short positions by buying shares.

when you square off

long will sell shares & short will buy shares

Intraday position: When you create such a position which you want to square off on the same day, then such position is called intraday position.

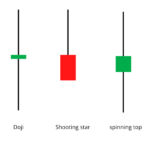

OHLC: OHLC means open high low close. You will learn about this in detail in the module of Technical Analysis. Now just understand that the open price of the stock means where it opened, the height to which its price went i.e. high, as far as the price went down i.e. low and the price which was at the time of closing of the market i.e. close.

For example, the OHLC of ACC on 17th June 2014 was O1486, H1511, L1467 and C1499.

Volume: The volume of a stock is the number of shares in the total number of trades (both buy and sell) in that stock on a given day. Understanding volume and its effect on share price is very important and you will understand this in more detail in the module of Technical Analysis.

Market Segment: There are different segments of the market in which different types of financial transactions take place. Segments are segregated on the basis of risk and reward. The exchange consists of three main segments.

Capital Market – In this segment shares, warrants, and exchange-traded funds are bought and sold. This segment is further divided into parts. Like common shares are sold and bought in the equity segment. This segment can be identified by the EQ mark.

Futures and Options: The futures and options segment is called the stock futures market. Leveraged product deals occur in this segment. This segment will be explained in detail in the Derivatives module.

Wholesale debt market: This segment of the market deals with fixed income products, such as government securities, treasury bills, bonds, and debentures.

Gaurav Heera is a leading stock market educator, offering the best stock market courses in Delhi. With expertise in trading, options, and technical analysis, he provides practical, hands-on training to help students master the markets. His real-world strategies and sessions make him the top choice for aspiring traders and investors.