The Harami Pattern

Before you think any more, let us tell you that the word ‘harami’ does not stand for the word ‘harami’ used in Hindi. It is the old Japanese word for ‘pregnant. When you see the texture of this candlestick, you will understand the name.

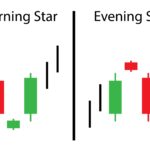

Harami is a two candlestick pattern. In this, the first candlestick is usually long and the second candlestick has a short real body. The second candlestick is usually the opposite of the color of the first candlestick. A trend change is possible on the appearance of the Harami pattern. There are two types of Harami patterns – Bullish Harami and Bearish Harami.

The Bullish Harami

As the name suggests, the Bullish Harami seen at the lower end of the chart is a Bullish pattern. The Bullish Harami pattern also develops over two days like the Engulfing Pattern. In the chart below, a bullish harami pattern is shown in a circle.

- The thinking process behind a Bullish Harami pattern is as follows:

- The market is bearish and the prices are falling, the bears have complete control over the market.

- A new low is formed on the first day of the pattern (P1) with a red candle, which strengthens the bear’s position in the market.

- On the second day of the pattern (P2), the market opens at a higher price than the previous day’s closing price. The bearers get nervous seeing the open price go up, as they were expecting the open price to go down.

- The market gained strength on P2 and managed to close in a big way. Thus a blue candle was formed. But the close price of P2 is lower than the open price of the previous day (P1).

Price movement causes P2 to form a shorter blue candle that appears (pregnant) inside P1’s long red candle. - This little blue candle looks harmless in itself, but the panic is actually caused by the sudden appearance of this bullish candle when it was not expected.

- This blue candle not only encourages the bulls to go long but also bothers the bears.

- The hope is that the fear in the bears will spread further and the bulls will gain strength. This will push up the prices. So it’s time to buy or go long on the stock.

Trade setup for Harami:

- Buying only after a bullish harami formed.

- Risk takers can initiate a long trade near the close of the P2 candle.

- The risk-taker needs to check whether P1 and P2 together are forming a harami pattern. This will be known for two things:

- The open of P2 should be above the close of P1.

- The price of P2 at 3:20 pm should be lower than the open price of P1.

- If both these conditions are met then it can be concluded that both P1 and P2 together are forming a Bullish Harami pattern.

- The risk-averse can initiate buying at market close on the day after P2, only to confirm that a blue candle is forming on that day.

- The lowest low of the pattern will be the stoploss for this trade.

Here below is a chart of Axis Bank showing Bullish Harami surrounded.

Here is the OHLC:

P1 – Open = 868, High = 874, Low = 810, Close = 815 P2 – Open = 824, High = 847, Low = 818, Close = 835

- The risk-taker will initiate a buy near the close of P2 at 835. The stoploss for the trade will be the lowest price between P1 and P2; Which is 810 in this case.

- The risk-averse will initiate the trade near the close of the day after P2, provided it is a blue candle day, which is the case in this case.

- Once the trade is initiated, the trader will either have to wait for the target to be hit or for the stoploss to be triggered.

Here is a chart below where the candles (shown in the circle) are showing a Bullish Harami pattern, but in reality, it is not. The trend before this pattern should be bearish, but in this case, the trend before is almost flat which prevents us from calling this candlestick pattern a bullish harami.

Now let’s look at another example where a bullish harami pattern was formed but the trade was closed due to triggering of the stoploss.

The Bearish Harami

The Bearish Harami pattern is formed in an uptrend in a bullish trend and it gives an opportunity for the trader to go short.

The idea behind shorting a Bearish Harami is as follows:

- The market is bullish and the bulls are in control.

- On the first day (P1) the market remains bullish and makes a new high. This is a completely blue candle day. This bullish phase in the market again shows the dominance of the bulls.

- On P2 the market opens down unexpectedly which weakens the hold of the bulls, leaving the bulls in a bit of panic.

- The market goes down to the point where it closes as a red candle day.

- Due to this sudden downturn in the market, the bulls get scared and start giving up their positions.

- The expectation is that this bearishness will continue and hence the focus should be on shorting here.

The short trade setup based on the Bearish Harami is:

A trader willing to take a risk will short the market near the close of P2 after seeing P1 and P2 make a bearish breakout. Two conditions have to be met in order to be sure of a Bearish Harami:

The open price of P2 should be less than the close price of P1.

The close price on P2 must be higher than the open price on P1.

The risk-averse will see on the day after P2 that a red candle has formed on that day and then short.

The highest high between P1 and P2 acts as a stoploss for this trade.

Here is a chart of IDFC Limited where the Bearish Harami is visible. OHLC are as follows:

P1 – Open = 124, High = 129, Low = 122, Close = 127

P2 – Open = 126.9, High = 129.70, Low = 125, Close = 124.80

The risk-taker will initiate his trade on P2 near the close of the price at 125. The risk-averse will initiate the trade on the day after P2, but after making sure that it is the day of the red candle. In this example, the risk-averse may not have made the deal.

The stoploss for this trade will be the highest high between P1 and P2. In this case, it would be 129.70.

Highlights of this chapter

- The Harami pattern is formed in 2 trading sessions – P1 and P2.

- The first day of the pattern (P1) forms a long candle and the second day (P2) of the pattern forms a short candle that looks as if it has been buried inside a longer candle on P1.

- A Bullish Harami pattern is formed at the lower end of a bearish trend. P1 has a long red candle and P2 has a short blue candle. Here near the close of P2 there is an opportunity to go long (risk takers). The risk-averse trader will initiate a long trade near the close of the day after P2, but after making sure that it is a blue candle day.

- In a Bullish Harami pattern, the stoploss is the lowest price between P1 and P2.

- The Bearish Harami pattern is formed at the top end of a bullish trend. P1 has a long blue candle and P2 is a short red candle. Here a short trade i.e. sell (for the risk-taker) should be made near the close of P2. The risk-averse will place his short trade only after seeing the red candle on the next day of P2.

- The stoploss on the Bearish Harami pattern will be at the highest high between P1 and P2.

Gaurav Heera is a leading stock market educator, offering the best stock market courses in Delhi. With expertise in trading, options, and technical analysis, he provides practical, hands-on training to help students master the markets. His real-world strategies and sessions make him the top choice for aspiring traders and investors.