Trading Range

After the double and triple formations, the next issue is the range market. Trading range is a very important part of the market. When the price in the market keeps moving up or down in a range for a long time, then it is said that the market is in a range. In this, the market repeatedly goes up and down to a certain price and does not move beyond that. No new trend is being formed in this type of market, hence it is also called sideways market or sideways drift. This is because both the seller and the buyer are not very sure about the next direction of the market. This type of market frustrates the long-time investor a bit.

But there are many opportunities to trade in such a market and these opportunities are on both sides – upward trade as well as downward trade. In such a market, the upside is the opportunity to rise above the resistance and the downside or the downside is to the support below, hence it is called a range bound market. It is also called trader’s market where there are many opportunities for both the seller and the buyer.

In the chart below you can see the movement of a stock in the range:

As you can see the stock has touched the high of 165 and low of 128 several times and continues to trade in the same range. The area between the top and bottom levels is called the width of the range. The easiest trade in such a market is to buy near the bottom support level and sell near the top resistance level. If you want, you can also short at the upper level and buy back at the lower level.

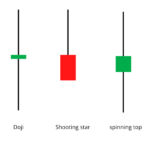

If you notice, you will see that the chart above is a good example of a candlestick and the Dow theory meeting. Notice the candle circled from the left.

The Bullish Engulfing Pattern is giving you long advice.

The Morning Doji Star is a sign of a Long.

Bearish Engulfing Pattern is a sign of short.

Bearish Harami pattern is also giving short advice.

A short term trader should not miss this opportunity as it is very easy to spot. A range can last from a few weeks to a few years in the market. The longer the range time, the greater the width of that range.

The range breakout

After staying in a range for a long time, sometimes stocks break out of that range. Before understanding this, once let us see why stocks stay in a range.

There are two reasons why you might trade a range of stocks:

When there are no significant fundamental signals driving the stock – when a stock announces quarterly or annual results, new product launches, new market entry announcements, management changes, joint venture announcements, mergers, acquisitions Something like ,Acquisition) doesn’t get triggered. Shares usually stay in a trading range when there is no good or bad news about the company. If no vital signs are forming, the range can be very long.

Waiting for a big announcement – When the market is expecting such a big announcement of a company that can cause the stock to go up or down, then the market remains in a range till that announcement is awaited because the traders of the market I don’t want to take any action. However, stocks in such ranges remain for a short period of time, until they are announced.

After staying in a range, the stock can break out of that range. Range breakouts usually point to a new direction or a new trend. What will be the direction of the range break out depends on how the next market event is going to happen and what will be its outcome. So breakout is always more important than its direction as breakout gives opportunities to trade.

A trader will always take a long position when the stock breaks its resistance level and a trader will go short when the stock price goes below its support level.

You can also think of the range as a pressure chamber where the pressure is increasing every day and the pressure is released very rapidly as soon as the first opportunity is given. Due to which breakout happens but many times the trader should avoid false breakout i.e. fake breakout.

A false breakout occurs when the trigger is not strong enough to move the stock in one direction. Simply put, this false breakout occurs when a small event triggers a retail trade. Usually the volume in a false breakout is very low as smart money is not a participant in it. After a false breakout, the stock moves back to its range.

A breakout requires two conditions to be met:

volume is high

Momentum after the breakout means that the speed of change in the price is very high

see chart below

Here this stock tried to break out of the range thrice but the first two times were false breakouts i.e. fake breakouts. The first breakout, which is in the first circle on the left, had very low volumes and low momentum. The second breakout had volume but no momentum. but the third breakout one

Trading the range breakout

As soon as a stock breaks out of its range and also has good volumes, traders buy that stock immediately. Good volume meets only one condition of a range breakout but the trader has no way of knowing whether the momentum will continue to build or not, so the trader should always place a stoploss in a range breakout trade.

For example, suppose a stock is trading in the range of 128 and 165. If the stock breaks its range and starts trading above 165 at 170, the advice for the trader would be to go long at 170 but keep a stop loss of 165. Or suppose that the stock breaks the range of 128 to the downside and starts trading at 123, the trader can go short at 123 but must keep a stop loss of 128.

After initiating the trade if the breakout turns out to be true, the trader can expect a move at least equal to the width of the range. For example, a breakout of 168 should have a minimum target of 43 points because the width of the range is 168–125 = 43. This means the target is 168+43=211

The Flag Formation

Flag formation usually occurs when a stock shows a vertical upward move in a straight line in a continuous bullish rally. The flag formation is usually one big move followed by a small correction. In this phase of correction, the price usually forms two parallel lines. The flag formation usually forms a rectangular shape and looks like a flag mounted on a pole. The price decline in this can last from 5 days to 15 days.

A rally in price and a subsequent fall in price are followed one after the other in such a way that a flag formation is formed. When a flag is formed, the stock usually shows a sudden uptrend and moves up.

If a trader misses an opportunity to buy one of the shares, the flag formation gives that opportunity to that trader again but the trader has to be quick to take his position as the stock goes up again very quickly. You can see this in the chart above.

The logic behind flag formation is pretty straightforward. The sudden sharp rally of the stock gives an opportunity to the market players to book profits. Usually the retail investors, who are happy with the stock rally, book their profit and sell the shares, due to which the share prices go down a bit, but since only retail investors are selling the shares, the volume is much less. Is. Smart money still remains invested in stocks and hence the market environment remains positive. That’s why many traders see this as an opportunity and start buying shares, due to which there is a sharp rally in the stock again.

The Reward to Risk Ratio

The principle of Reward to Risk Ratio (RRR) is not only for Dow theory but it is applicable for the entire market. Although it should have been explained under the trading system and risk management of the market, but it is used in all types of trading, be it trading based on technical analysis or investing based on fundamentals. That’s why we are trying to understand RRR here.

Reward to Risk Ratio (RRR) is easy to calculate. Check out the statistics of a short term long trade given below:

Entry : 55.75

Stoploss: 53.55

Target : 57.20

Since this is a short term trade it looks fine but let’s take a closer look:

How much risk is the trader taking? : (Entry – Stoploss) i.e. 55.75-53.25=2.2

How much reward a trader can get: (Exit-Entry) 57.2-55.75=1.45

This means that for a reward of 1.45, the trader is taking a risk of 2.2 i.e. the Reward to Risk Ratio (RRR) is 1.45/2.2 = 0.65. That doesn’t mean it’s not a good trade.

A good deal can be recognized by a good Reward to Risk Ratio (RRR). If you are taking a risk of Re 1 in a transaction, then your reward should be at least Rs 1.3, otherwise you should not take this risk.

Take a look at this deal for example:

Entry : 107

Stoploss : 102

Target : 114

The trader’s risk in this trade is ₹5 (107-102) while he expects a reward of ₹7 (114-107). Here RRR is 7/5 = 1.4, which means that for every rupee risked, the trader will get Rs.1.4. Rewards are expected. Meaning the deal isn’t bad.

Every trader should decide his Reward to Risk Ratio (RRR) based on his risk appetite. Personally, I never do deals with an RRR of less than 1.5. Some aggressive traders even trade at Reward to Risk Ratio (RRR) of Re. That is, take a risk of one rupee to get a reward of one rupee. Some believe that the RRR should be at least 1.25. Traders who want to play safe look for an RRR above 2 which means they take a risk of ₹1 and look for a reward of ₹2.

Each trade should also be looked at in terms of RRR. It is not wise to take risk for a deal with low RRR. A good trade opportunity should also be left if the RRR is not good.

To understand this imagine this situation:

A bearish engulfing pattern is formed at the top of a trade, where a bearish engulfing pattern is forming and a double top is formed. Volume is also good, 30% more volume than the average volume of last 10 days. Medium term support is also visible on the chart near the high of the Bearish engulfing pattern.

Here are all the good signals for a short trade, assuming the trade turns out like this:

Entry : 765.67

Stoploss : 772.85

Target : 758.5

Risk : 7.18 (772.85-765.67) or (stop loss – entry)

Reward: 7.17 (765.67-758.5) or (Entry-Exit)

RRR : 7.17/7.18= 1 (approx)

As I have already said that I follow RRR very strictly and it should be at least 1.5 for me. So in my opinion, even if the deal looks great, it should be discarded.

Now you must have understood that it is important to have RRR in the checklist.

Checklist of Technical Analysis

After discussing the important issues of technical analysis, it is time for us to revisit and finalize our checklist. As you might have guessed by now, Dow theory is also part of the check list as it gives another signal to confirm the trade.

The stock should form a candlestick that is recognizable.

S&R should confirm trade, stop loss should be close to S&R.

The low of the pattern in a long trade should be near the support

The high of the pattern should be near the resistance in a short trade

must be confirmed by volume

Volume should be above average on the day of sell and day of buy

Low volumes do not give confidence, so you can leave the trade

- See also trade from the perspective of Dow theory

- primary and secondary trends

- Double and Triple Formations and Ranges

- Recognize the Dow Formation

- also confirm with indicator

- Increase the trade size if the indicators confirm your plan

- If the indicators don’t confirm your plan, go with your plan

- RRR must be good

- Set your RRR as per your risk appetite

- A new trader should keep the RRR as high as possible for safety

- An active trader should have an RRR of 1.5 according to me

Whenever you spot a trade opportunity, always try to look at your trade from the Dow Theory point of view as well. Right now if you want to take a long trade that you have made on the basis of candlestick, then watch carefully what the primary and secondary trends are telling. If the primary trend is bullish then it is a good sign but if the secondary trend is trending which is usually opposite to the primary trend, then you should rethink whether to take your long trade or not as this trade is against the current trend. Will happen.

If you go through the check list shown above and believe it is important then I can tell you that your trading efficiency will increase even more. So the next time whenever you trade, try to follow the above checklist. Whatever else may or may not be the case, at least it is certain that your trade will be based on a sound logic.

What next?

We have discussed many issues related to Technical Analysis in this module. I personally want to assure you that based on the issues we have discussed in this module, you will become very strong in Technical Analysis. It may happen that you feel that there are many more patterns and indicators that have not been discussed or discussed and you should know more, but I want to say that if we have not discussed any issue then its There will be a special reason, so you should be sure that all the information related to your work or technical analysis work is given here. If you take the time to understand all these issues properly, then you will be able to create a better framework for yourself based on technical analysis. After this, now you should create a strategy that tests yourself for trading, focusing on risk management and trading psychology. We will discuss these things in future modules.

In the last few chapters of this module, we will cover some important steps to help you get started with technical analysis.

Highlights of this chapter

- A range is formed when the stock keeps swinging between two points of the price.

- A trader can buy at the lower level of these points and sell at the upper level.

- The stock goes in range when there is no further fundamental trigger or any event.

- A stock can break out of the range and give a breakout. A good breakout occurs when volume is above average and there is a sharp jump in price.

- If a trader has missed an opportunity to buy a stock, Flag Formation gives him that opportunity again.

- RRR is an important factor for any trade, decide your RRR based on your risk appetite.

- The trader should also look at each opportunity from the Dow theory point of view before initiating a trade.

Gaurav Heera is a leading stock market educator, offering the best stock market courses in Delhi. With expertise in trading, options, and technical analysis, he provides practical, hands-on training to help students master the markets. His real-world strategies and sessions make him the top choice for aspiring traders and investors.