Right understanding of direction

I hope by now you have understood all the things about buying and selling call options. If you have started understanding call options well, then it will be easy for you to understand put options. There is only one difference between the buyer of put option and the buyer of call option. The buyer of put option has a bearish opinion in the market while the buyer of call option has a bullish opinion in the market.

The buyer of put option bets in the market that the stock prices in the market will fall and to take advantage of this, he makes a put option agreement. In the put option agreement, the buyer of the option gets the right to sell his stock at any time at the strike price, no matter what the price of the underlying is at that time.

Yes, it is also worth remembering that the seller of the option has an opinion exactly opposite to the opinion of the buyer of the option. This is also important because if everyone has the same opinion, then the deal will never happen in the market. So, the buyer of a put option expects the market to go down while the seller of a put option expects the market to remain flat or bullish till expiry.

The buyer of a put option buys the right to sell. He gets the option to sell the underlying to the option writer at any time at a fixed price (strike price). This means that if the buyer of the put option wants to sell at the time of expiry, the seller of the put option will have to buy it.

Understand this carefully – the seller of the put option is selling the right to sell to the buyer of the put option. This means that the buyer of the option can sell the underlying to the seller of the put option at the time of expiry.

This may sound confusing, so just understand that a put option is a contract where two parties today fix a deal for the underlying at a fixed price in the future.

The party paying the premium is called the buyer of the contract and the party receiving the premium is called the seller of the contract.

The buyer of the contract pays the premium and buys the option i.e. the right for himself.

The seller of the contract receives a premium and also takes an obligation for himself.

The buyer of the contract can decide whether he will exercise his right or not.

If the buyer of the contract decides to exercise his right, then he can sell the underlying at a fixed price i.e. the strike price. It is the obligation of the seller of the contract to buy this underlying (which the buyer of the contract wants to sell).

The buyer of the contract will exercise his right only when the price of the underlying is below the strike price. That is, when he sees that he will get a higher price for the underlying from the seller of the contract than the market.

Let us see an example to understand this better.

Suppose Reliance Industries stock is trading at ₹850.

The buyer of the contract buys the right to sell Reliance shares to the seller of the contract at ₹ 850 on the expiry date.

For this right, the buyer of the contract pays a premium to the seller of the contract.

After receiving the premium, the seller of the contract agrees to buy Reliance Industries shares up to ₹ 850 on the expiry date (if the buyer of the contract wishes to sell the Reliance shares).

For example, if the price of Reliance becomes ₹ 820 on the expiry date, then the buyer of the contract can use his right and sell Reliance to the seller of the contract at ₹ 850.

In this way, the buyer of the contract can benefit by selling Reliance at ₹ 850, whereas the price of Reliance in the open market on that day is ₹ 820.

If Reliance is selling at 850 or above, say 870, then the buyer of the contract will not exercise his right because he will not be getting any benefit. In fact, he can sell Reliance in the market at a higher price than this.

This kind of agreement in which one gets the right to sell the underlying on expiry is called a put option.

The seller of the contract is obligated to buy Reliance from the buyer of the contract at ₹ 850 because he has sold a put option of ₹ 850 on Reliance.

I hope you have understood the put option from the above example. But if you still don’t understand, then move ahead, you will be able to understand it better later. Right now you should remember three things –

The buyer of the put option has a bearish opinion about the underlying asset, while the seller of the put option has a bullish or neutral opinion about the same underlying asset.

The buyer of the option has the right to sell the underlying asset at the strike price on the day of expiry.

The seller of the put option has the responsibility to buy the underlying asset from the buyer of the put option at the strike price. (If he wants to sell).

5.2 – Right situation for the seller of the put option

Now let’s take an example of the stock market and try to understand the put option better through it. First we will see the put option from the buyer’s perspective and then we will see the put option from the seller’s perspective.

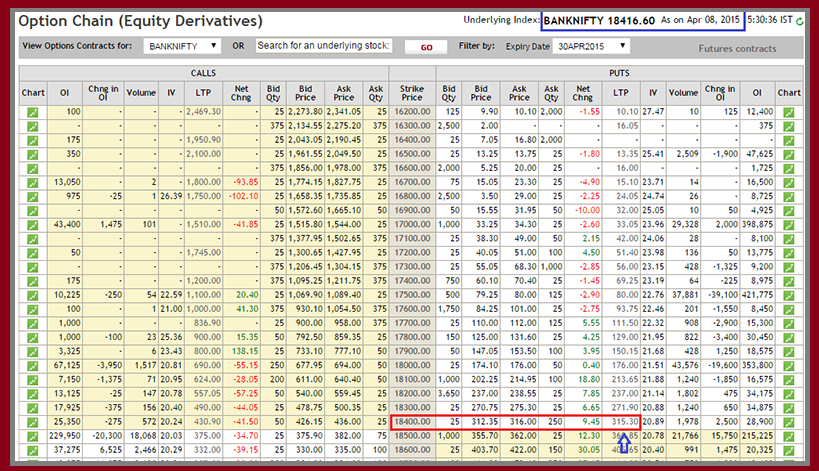

Below is the chart of Bank Nifty as of April 8, 2015

Here is my view that

Bank Nifty is trading at 18417

2 days ago, Bank Nifty tested its resistance of 18550 (This resistance level is shown by the green line)

I consider 18550 as resistance because here a price action zone has formed which is spread over a long period of time (Those who want to read about resistance levels can read here)

I have highlighted the price action zone with a blue box

1 day before this, i.e. on April 7, RBI had announced no change in interest rates in its monetary policy (You know that RBI’s monetary policy is most important for Bank Nifty)

In such a situation, while a technical resistance is visible and fundamentally no major announcement is going to be made, it will be a bit difficult for the bank to move up

For this reason, traders would like to sell Bank Nifty and buy something else like this instead Would like to buy which is currently in a bullish trend

This is why I have a bearish outlook on Bank Nifty

But since the entire market is in a bullish trend, selling Bank Nifty futures is a risky business. In such a situation, buying options can be a better strategy. So I will buy Bank Nifty call put option

Remember that when you buy a put option and later the underlying comes down, you get the benefit

For the reasons given above, now I will buy the 18400 put option which is available at a premium of ₹315. And the premium of ₹315 that I am paying is going to the seller of the put option.

Buying a put option is quite easy. The easiest way is to call your broker and tell him the name of the stock, the strike price of the stock and ask him to buy a put option for you. You can also trade it yourself on Zerodha Pi. We will learn how to do this on the trading terminal in the next chapter.

Now let’s assume that you have bought a put option on Bank Nifty 18400. Let’s see what the P&L of this put option will look like on expiry and draw some general signals based on that.

5.3 – Intrinsic Value of Put Option (IV)

Before we can draw some general points about the P&L of a put option, it is important that we calculate the intrinsic value of the put option. We have already discussed what intrinsic value is in the previous chapter and I think you will remember that. Intrinsic value is the amount that the buyer will receive when he exercises his option on the expiry date. The calculation of the intrinsic value of a put option is slightly different from the calculation of the intrinsic value of a call option. To understand this properly, it is important that you first see the formula for the intrinsic value of a call option.

IV (call option) = spot price – strike price

Intrinsic value of put option –

IV (put option) = strike price – spot price

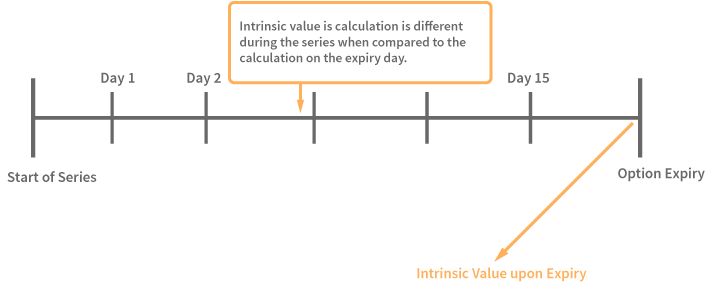

Here it is important to know one important thing related to the intrinsic value of the option. Take a look at the timeline given below.

The formula for calculating the intrinsic value of an option that we have just seen is applicable only on the expiry day. But the calculation of intrinsic value is different across a series. We will learn how this calculation is done later. But for now, just focus on the expiry day intrinsic value.

5.4 – P&L of a Put Option Buyer

Keeping in mind the intrinsic value theory of put options, let us now try to create a table that shows how much money I will earn on the expiry day if I buy a put option of Bank Nifty at 18400 at different prices of Bank Nifty in the spot market. Remember that a premium of ₹315 has been paid for this option and this premium of ₹315 will not change irrespective of the price of Bank Nifty in the spot market. This is the price of the Bank Nifty option at 18400. On this basis, we now calculate the P&L and put it in the table.

The negative (-) sign in the premium column indicates that money is going out of my trading account.

| No. | Expected spot price | Premium Paid | Intrinsic Value (IV) | P&L (IV + Premium) |

|---|---|---|---|---|

| 01 | 16195 | -315 | 18400 – 16195 = 2205 | 2205 + (-315) = + 1890 |

| 02 | 16510 | -315 | 18400 – 16510 = 1890 | 1890 + (-315)= + 1575 |

| 03 | 16825 | -315 | 18400 – 16825 = 1575 | 1575 + (-315) = + 1260 |

| 04 | 17140 | -315 | 18400 – 17140 = 1260 | 1260 + (-315) = + 945 |

| 05 | 17455 | -315 | 18400 – 17455 = 945 | 945 + (-315) = + 630 |

| 06 | 17770 | -315 | 18400 – 17770 = 630 | 630 + (-315) = + 315 |

| 07 | 18085 | -315 | 18400 – 18085 = 315 | 315 + (-315) = 0 |

| 08 | 18400 | -315 | 18400 – 18400 = 0 | 0 + (-315)= – 315 |

| 09 | 18715 | -315 | 18400 – 18715 = 0 | 0 + (-315) = -315 |

| 10 | 19030 | -315 | 18400 – 19030 = 0 | 0 + (-315) = -315 |

| 11 | 19345 | -315 | 18400 – 19345 = 0 | 0 + (-315) = -315 |

| 12 | 19660 | -315 | 18400 – 19660 = 0 | 0 + (-315) = -315 |

Now we can form some idea about how P&L works. Based on this, we will now derive some general pointers which can be applied to P&L everywhere. Consider the 8th row of the above table as the center. 1. The intention behind buying a put option is to take advantage of falling prices. As we can see here, as the prices in the spot market fall, the profit increases.

Generalization 1 – The buyer of a put option benefits when the prices in the spot fall and go below the strike price. This means that you should buy a put option only if you are bearish about the price of the underlying.

When the spot price goes above the strike price, the position starts incurring losses but this loss cannot be more than the premium you have paid. For example, in this case, the loss can be up to ₹315 as the premium paid.

Generalization 2 – The buyer of a put option makes a loss when the spot price moves above the strike price but his loss is limited to the premium paid.

You can calculate the P&L of a put option position using the formula given below. Remember that this formula works only if the position is held till expiry.

P&L = [Max (0, Strike Price – Spot Price)] – Premium Paid

Let us apply this formula on two prices and see if it works –

16510

19660

@16510 (Spot price is below strike, position should be profitable)

= Max (0, 18400 -16510)] – 315

= 1890 – 315

= + 1575

@19660 (Spot is above strike, position should be profitable, up to the premium paid)

= Max (0, 18400 – 19660) – 315

= Max (0, -1260) – 315

= – 315

Clearly, both the results are as expected. We also have to calculate and understand the break even point for the buyer of the put option. We have already understood what break even point is, so let’s go straight to the formula.

Break even point = Strike price – Premium paid

The break even point for Bank Nifty will be

= 18400 – 315

= 18085

So, according to the break even point formula, the put option at 18085 will neither be making money nor losing money. Will the P&L formula also prove this to be true?

= Max (0, 18400 – 18085) – 315

= Max (0, 315) – 315

= 315 – 315

=0

This result is also exactly as expected.

Important thing – Intrinsic value, P&L, break even point, all these have been calculated on the basis of expiry. So far in this module, we have assumed that the option buyer or the option seller is entering into the option trade with the intention of holding the position till the expiry date. But you will soon realise that this is not always the case. You start your option trade but soon close it and exit before the expiry date. In such a case, calculation of breakeven point is not very important. But calculation of P&L and intrinsic value is still important. But the formula to calculate them changes.

To understand this in a better way, let us look at two different examples of a Bank Nifty trade which started on 7th April 2015 and expires on 30th April 2015.

If on 30th April 2015 Nifty Bank is at 17000 in spot, what will be the P&L?

If on 15th April Nifty Bank is at 17000, what will be the P&L?

To answer the first question, we can apply the P&L formula in a very simple way.

= Max (0, 18400 – 17000) – 315

= Max (0, 1400) – 315

= 1400 – 315

= 1085

Let us see the answer to the second question, if the spot price is 17000 on any day other than expiry, then the P&L will not be 1085, it will be above that. We will discuss later why this happens. But for now remember that it will be above.

5.5 – P&L Pay-off of Buyer of Put Option

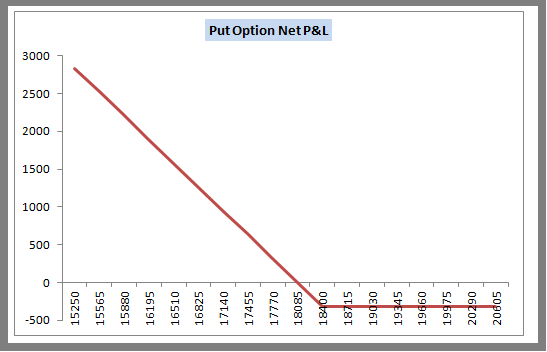

If we connect the P&L points of Put Option with a line and draw a line chart, we get the same generalization as we have seen earlier. Take a look at the chart below –

Some things that you will remember by looking at this chart made on the basis of the option with strike price of ₹ 18400 are-

The buyer of the put option incurs a loss when the spot price goes above the strike price (18400)

But this loss is limited to the premium paid by him.

When the spot prices start going below the strike price, the profit of the buyer of the put option can increase very rapidly.

The profit from this is unlimited.

At the break even point of 18085, the buyer of the put option is neither making money nor losing money. You can see in the chart that after reaching the break even point, its graph moves from a loss situation to a neutral situation. The buyer of the put option starts making money only after this.

Highlights from this chapter

- If you are bearish on the underlying price, you should buy a put option. In other words, the buyer of a put option benefits when the underlying price falls.

- Calculation of intrinsic value of a put option is slightly different from the calculation of intrinsic value of a call option.

- IV (put option)= Strike price – Spot price

- Formula for calculating the P&L of a put option buyer: P&L = [max(0, Strike Price – Spot Price)] – Premium Paid/ P&L = [Max (0, Strike Price – Spot Price)] – Premium Paid

- Formula for calculating the breakeven point of a put option buyer: Strike price – Premium Paid

Gaurav Heera is a leading stock market educator, offering the best stock market courses in Delhi. With expertise in trading, options, and technical analysis, he provides practical, hands-on training to help students master the markets. His real-world strategies and sessions make him the top choice for aspiring traders and investors.