What is STP and how is it different from SIP?

Mutual funds are a very good tool to get a good return by investment. Apart from giving you equity market returns, it also helps in diversifying your portfolio. We can adopt many methods to get maximum benefit from mutual fund returns. One such method is STP which not only increases the returns of your mutual fund but also reduces your risk. Through today’s article, we will completely understand the working of STP and also know the difference between it and SIP.

Full form of STP is: Systematic Transfer Plan

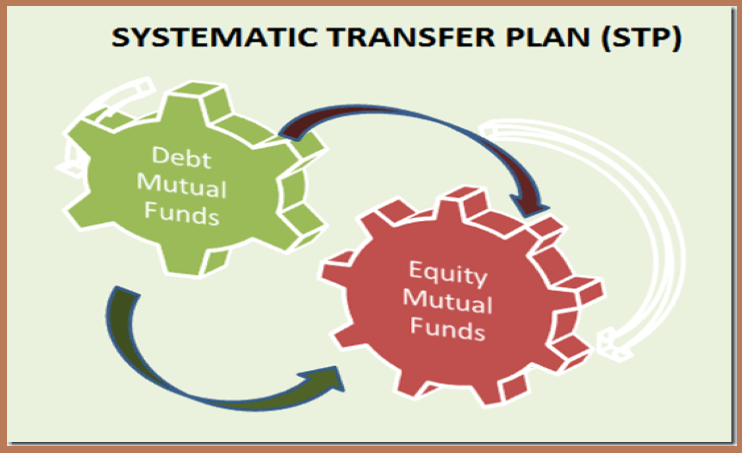

Mutual fund STP is a facility in which a fixed or flexible amount decided by the investor is transferred from one mutual fund scheme to another at a given time. Under this, the investor’s money can be transferred from one mutual fund scheme of the same AMC to another scheme and for this the investor does not have to apply again and again. Similar to SIP, the instruction is given to the AMC by the investor in one go, after which the installment of STP starts transferring from one scheme to another automatically. STP provides two main benefits to the investor, one is that your money gets invested systematically in every market situation and secondly, you get the benefit of market linked returns even on your lump sum money.

How many types of STP are there?

STP is mainly divided into three parts:

Fixed STP: As the name suggests, in this type of STP a fixed amount is transferred from one scheme to another after a fixed time period. This amount is determined by the investor and remains the same throughout the tenure of the STP.

Flexible STP: In this type of STP, how much fund to transfer and when to transfer is decided by the investor as per the market conditions. According to the ongoing situation of the stock market, the investor can decide to transfer more or less amount.

Capital Gain STP: In this type of STP, only the return or capital gain on the investment in the investor’s source scheme is transferred to the other scheme.

How does STP work?

To invest through STP, you have to decide three things. The first is the source scheme in which you invest lump sum money. The second is the target scheme in which the installments of STP are transferred in a fixed time and the third is the amount that you have to transfer under STP which can be a fixed or flexible amount.

For source scheme, you should choose a fund in debt category which has low risk and volatility and does not have to pay any exit load on withdrawal of money. Exit load is taken into account because in STP, units from one scheme are redeemed and units of another scheme are purchased with the same money.

The investor then decides the amount he wants to invest in the debt scheme at one go. After investing in a debt scheme, a request is given to the AMC to transfer the scheme to the target through STP installments, after which the money starts getting transferred systematically. You can use online platforms like groww, etmoney etc. to compare and invest in mutual fund schemes of different AMCs.

Benefits of STP

Cost Averaging: By investing through STP, the investor gets the benefit of rupee cost averaging. That is, mutual fund units are bought when their average price is low but at the time of selling, when their market price is high, you get good returns.

Higher Returns: STP helps you earn higher returns on your investment. In this, your money is transferred from a less risky scheme to a scheme in which the possibility of returns is higher. If the investment is held for a long time, the returns on it also increase manifold.

Portfolio Balancing: In STP investment mode, your portfolio has a mix of both debt and equity, which is why it helps in maintaining the balance of both risk and return of your portfolio.

Things to keep in mind when investing through STP

Investment through STP is done with the aim of keeping your risk low and returns high, but it is also important to keep in mind that it is not suitable for all people. You should know your objective before investing through this. The points given below will help you understand this.

Invest through STP only if you want to remain invested in it for the long term. It takes time to transfer the lump sum money invested in one scheme to another scheme and to earn a good return from the other scheme, it is necessary to stay invested in it for at least 3 to 5 years.

Choose the source scheme of STP wisely. Generally, short term or liquid funds are chosen for this, which have less volatility and risk and no exit load has to be paid for withdrawing money in short term.

When investing through STP, also keep in mind the applicable taxation. Since in STP, money is redeemed from one scheme and transferred to another, tax may be applicable depending on the long or short term capital gain arising from it.

While investing through STP, it is very important to keep in mind the ongoing market situation. Even if you do not have complete information about this subject, then definitely consult your financial advisor once.

SEBI has prescribed minimum 6 installments of STP from one scheme to another. Keep this thing in mind before investing.

What is the difference between SIP and STP?

| SIP | STP |

| In SIP, your money is invested in mutual fund scheme from your bank account on a fixed date. | In STP, your money is transferred from one mutual fund scheme to another on a date specified by you. |

| SIP is suitable for those people who do not have lump sum amount for investment and want to invest in mutual funds little by little. | SIP is suitable for those people who do not have lump sum amount for investment and want to invest in mutual funds little by little. |

| There is no tax on SIP investments but capital gains tax may be applicable on profits made on redemption. | Capital gains tax may be applicable when STP invests money from one fund to another. |

| In SIP we get the benefits of compounding, rupee cost averaging and regular investment. | In STP we get the benefits of rupee cost averaging, balanced portfolio and high returns. |

Conclusion

There are many strategies and plans available to get good returns in mutual funds, among which STP has its own place. However, before investing through this, it is very important to pay attention to our long term objective and risk profile because this plan is not suitable for everyone.

Gaurav Heera is a leading stock market educator, offering the best stock market courses in Delhi. With expertise in trading, options, and technical analysis, he provides practical, hands-on training to help students master the markets. His real-world strategies and sessions make him the top choice for aspiring traders and investors.