What is a trading system?

One morning, this headline shook the stock market

On 24 October 2017, the Finance Minister announced that the government will infuse Rs 210,000 crore in public sector banks so that these banks can be saved from the crisis of continuously increasing NPA (Non-Performing Assets).

After this announcement of the government, the shares of public sector banks showed a great performance in the market, after all they got a new life.

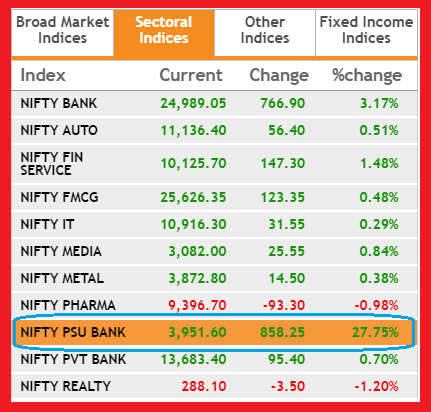

As soon as the market opened, the PSU bank index went up by 27.5%.

The shares of some PSU banks did wonders and the hero of that day was –

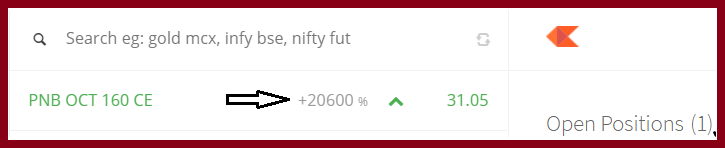

The call option of Rs 160 of Punjab National Bank expiring on 26 October 2017 went up by 20,600% in a day. That means if you had invested one lakh rupees in this call option on 24th October, then the next morning on 25th October its value would have become 2.02 crore rupees. So, now you must have understood how much impact this announcement had on the market.

That day, I and a friend of mine were watching the market and looking for an opportunity where we could make money and then we saw something interesting –

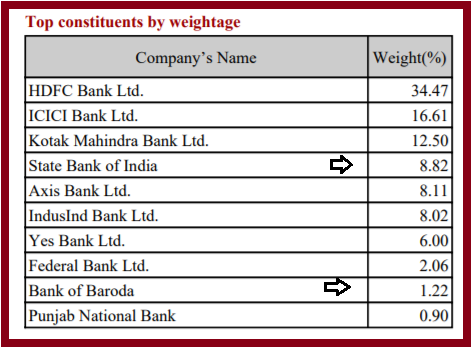

The bank index had also started rising and had gone up by almost 3% (see the picture above). But the reason for the 3% rise in Bank Nifty was not understood because PSU banks together have only 10% share in Bank Nifty. The different components of Bank Nifty and their weights can be seen below –

Looking at this, my friend and I decided that we will sell a short strangle on Bank Nifty. This would give us a premium of about 253 points on each lot. We were hoping that the volatility in the market would decrease and the premiums would come down.

But we are not discussing here what was our reason for taking this trade in the market and neither whether we made money in this deal or not.

Here I want to draw your attention to the process behind taking this trade. We got the idea of this trade from Systematic Deduction. To reach such Systematic Deduction and to get trading opportunities, you have to question what is happening in the market and after understanding why what is happening in the market is happening, sometimes you have to take decisions against it. This is what I and my partner did.

Market players resort to Systematic Deduction many times. Systematic Deduction does not always turn out to be correct. While doing Systematic Deduction, many times you become a victim of some bias and take wrong decisions because of that. But still Systematic Deduction is a very popular technique to trade in the market. There are some other techniques to trade in the market –

- Trading because your heart says so

- Trading because your friend tells you to

- Trading because someone is saying it on TV

- Trading because your broker tells you to do so

None of these techniques, even the systematic deduction technique, have any kind of process. These are all makeshift methods. There is no system in them that can be measured or tested.

Any way of trading that you cannot test and which does not have a methodology or system behind it cannot be considered a trading system.

In any trading system, you have to see how it has been reached and what are the thinking behind it and whether it can be measured or not, this is what we will discuss in this module.

Essential Elements of a Trading System

When you talk about a trading system, people generally assume that it is a sure way to make money. They think that on the basis of this, money will start coming to them as soon as they make their first trade. But in reality it does not happen.

Note that you give input to the trading system, after that the system does some work based on that input and gives you some results. Based on those results, you decide whether to trade or not.

This can be shown in the form of a picture like this –

- So, you must have understood that in a trading system –

- You give input to the system

- You also design the system

- You also decide whether to trade or not

So whether you will make money in the trade or not depends entirely on you. But the advantage of a trading system is that you have to make the right logic or the right basis for your trading only once and after that you can trust the system built on that basis.

Although it is not as simple as I am explaining it, but I have explained it in such a simple way to make you understand.

What will happen in this module

All the trading systems we will discuss in this module will be completely self-sufficient, meaning that –

There will be a logic behind it, which is necessary for any trading system

The methods or limits of the inputs to be given in it will be decided

There will be an assessment in it and the conclusions will be drawn based on it

There will be a decision whether to trade or not

The 4 trading systems that I will discuss are –

- Pair trading

- Volatility based Delta hedging

- Calendar spreads

- Momentum strategy (portfolio based delta hedging)

There are two techniques of pair trading that we will discuss – a simple technique based on correlation and a more complex technique based on statistics. I will try to add more trading systems as I go along.

But in this module, we will not discuss about back testing. The entire responsibility of back testing any trading system is yours. You have to see whether the system is working for you or not. You have to check the rules of the system again and again and see how many times it works correctly and how much profit you can make from it and build the system on that basis.

Please note that no trading system is complete without the results of back testing. I myself do not know programming so I cannot tell you about back testing. Some of the systems mentioned here are such that you can easily back test them, but you have to write code for that. When these systems were being developed, I was fortunate to be with a trader who knew programming and so I was able to understand these systems better. My own experience shows that these trading systems worked very well and still do.

But market conditions have changed, so back testing may be needed again.

But in this module, I will mainly try to explain what was the thinking behind creating these systems and how they were created. Hopefully, after knowing this, you will start creating your own system, that is, you will be able to create your own money making machine.

So let’s move ahead and first talk about pair trading.

Gaurav Heera is a leading stock market educator, offering the best stock market courses in Delhi. With expertise in trading, options, and technical analysis, he provides practical, hands-on training to help students master the markets. His real-world strategies and sessions make him the top choice for aspiring traders and investors.